A Plea for More Transparency

On February 15, 2011, the Parliamentary Budget Officer (PBO) appeared before the House of Commons Standing Committee on Finance to present his updated fiscal forecast[1] and to raise with the Committee a number of issues in the context of the upcoming 2011 Budget.

Economics Assumptions

The PBO used the economic projections from the Department of Finance’s December 2010 survey of private sector forecasters[2], released on February 1, 2011. These were slightly more optimistic than those used by the Department of Finance in the October 2010 Update.

The PBO identified four key downside risks to the private sector forecast: global growth, especially in the U.S. could be slower than anticipated; the appreciation of the Canadian dollar could adversely affect exports; sovereign debt issues in Europe could restrain recovery there and put upward pressure on global interest rates; and the high level of household debt in Canada could restrain domestic demand. These risks underlie the need for prudence in planning the next budget.

Fiscal Forecast

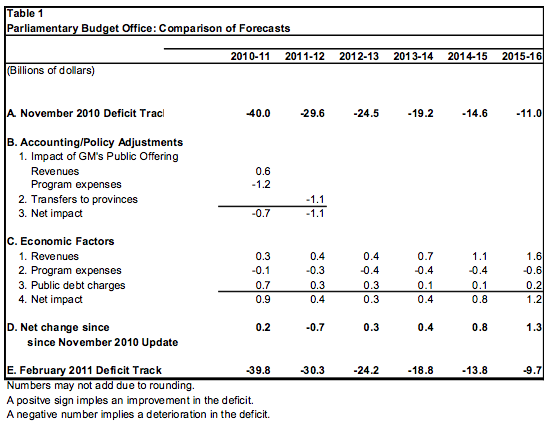

The PBO updated their November 2010 fiscal forecast to incorporate the impact of the slightly more positive economic outlook and accounting/policy factors announced since their November 2010 Update[3] (see Table 1). The accounting/policy factors related to the Government of Canada selling approximately 17 per cent of its shares in General Motors. This resulted in a net gain in budgetary revenues of $0.6 billion, but an expense of $1.2 billion, resulting from the revaluation of its liability to Ontario[4]. In addition, the Minister of Finance announced on December 20, 2010 that the Government would extend by one more year the protection to provinces to ensure that none would experience a decline in their major transfers from the federal government in 2011-12[5]. This is estimated at $1.1 billion in 2011-12.

The net impact of the slightly more positive economic forecast is to lower the deficit by $0.9 billion in 2010-11 from their November 2010 Update, primarily due to the impact of lower-than-forecast interest rates on public debt charges. The deficit improves by $0.4 billion in 2011-12, increasing slowly to $1.2 billion by 2015-16, as somewhat higher revenues and lower public debt charges more the offset higher program expenses. The higher revenues primarily reflect higher employment insurance premium revenues in the short term and increased personal income tax revenues in the last two years of the forecast period.

On balance, the PBO projects a slightly lower deficit in 2010-11, somewhat higher in 2011-12, due to the extension of the protection of transfers in 2011-12, and small improvements throughout the rest of the forecast period ( Table 1, Panel D) from that projected in their November 2010 Update. A deficit of $9.7 billion is forecast for 2015-16.

Comparison to October 2010 Update

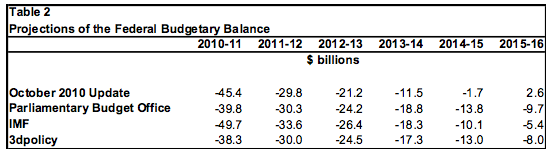

Table 2 shows the fiscal projections presented by the Minister of Finance in the October 2010 Update, the revised PBO forecast, the projections by the International Monetary Fund[6] (IMF) and our own projections (3dpolicy)..

At this time, only the Minister of Finance is forecasting a surplus in 2015-16. Based on analysis by the PBO, there is only a 16 per cent probability of a surplus in that year.

A Plea For Greater Transparency

The PBO emphasized the need for greater transparency in the budget forecast. As we have noted previously (www.3dpolicy.ca)[7], the private sector forecasters are only surveyed for a selected number of economic aggregates. The private sector forecasters do not decompose their forecast of nominal income and expenses into their respective components, nor do they prepare the fiscal projections. This is done by the Department of Finance. The PBO, like us, strongly believes that the Department of Finance should publish their forecasts of the components of national income (e.g., corporate profits) and expenses, rather than claiming that such information cannot be released due to “Cabinet Confidence”. The last time this information was publicly released was in the November2005 Economic and Fiscal Update. It should be a regular feature of the budget and economic updates.

The PBO also noted, like the IMF and ourselves, that Canada is facing a serious fiscal challenge due to the ageing demographics and weak population growth and as a result, Canada does not have a sustainable fiscal structure. He notes that the Government committed in 2007 to produce a long-term sustainability analysis and encourages the Government to deliver on this promise in the 2011 Budget. The IMF made the same recommendation in its latest report.

Finally, the PBO expresses concerns over the lack of detailed costing information for new policy initiatives and a plan to secure the spending restraint savings announced in the 2010 Budget. The PBO believes that Parliament is losing control over its fiduciary responsibilities, as set out in the Constitution, by approving legislation without knowing the full impact such legislation will have on the budgetary projections

[1] Economic and Fiscal Assessment Update: Parliamentary Budget Officer February 15, 2011

[2] Harper Government’s Economic Projections on Track: Department of Finance February 1, 2011

[3] Economic and Fiscal Assessment 2010: Office of the Parliamentary Budget Officer November 3, 2010

[4] For more details see the November 2010 Fiscal Monitor Department of Finance.

[5] Department of Finance Press Release: Ensuring a Strong Retirement System, Support for Provinces and Territories while Moving Towards Budget Balance: December 20, 2010

[6] IMF Board Concludes 2010 Article IV Consultation with Canada: IMF December 22, 2010.

[7] Time to Make the Budget Planning Process More Accountable, Transparent and Accountable: November 2010, www.3dpolicy.ca..

Add new comment