Fiscal Forecasting is Neither a Science Nor an Art

There has always been, and continues to be, considerable skepticism concerning the federal government’s fiscal projections. During the 1990s and early 2000s, when projections of the budgetary balance were off by wide margins, the credibility of the Department of Finance’s forecasting abilities came under attack from both inside and outside the government. Because of public criticism, the Department of Finance commissioned two independent studies, one in 1994 and one in 2005 to examine the reasons underlying the inaccuracy of budget forecasts and how they might be improved.

Both studies came to the same basic conclusion: that the risks and uncertainties involved in budget forecasting were simply too large to allow for a high level of forecast accuracy. Both studies made recommendations on how to improve the process and transparency of budget forecasting, most of which were readily adopted by the governments at that time. Unfortunately, these recommendations have not been followed since 2006.

Probably the most remembered forecast error in recent years will be in the November 2008 Economic and Fiscal Update, where small surpluses were projected throughout the entire five-year forecast period, even though the economy had already entered a recession. However, to the surprise of no one except the government, about two months later, the January 2009 Budget forecast deficits of about $30 billion for both 2009-10 and 2010-11, with the budget not expected to return to a surplus until 2013-14. The final deficit outcome for 2009-10 was $55.6 billion.

This paper highlights the major factors that make budget forecasting ‘a mugs game” but a necessary “mugs game”.

Factors Affecting Budget Projections

The in-year changes to the status quo deficit forecast are affected by a number of factors.

- Budget forecasts are based on preliminary deficit results for the previous year. If that base is off, the current year’s forecast will also be off;

- Major components of the budget are highly sensitive to changes in economic developments;

- Forecasts of personal income tax are based on inadequate data;

- Budget forecasts are based on accrual accounting concepts; whereas Parliamentary appropriations are based on cash accounting concepts;

- Government departments normally do not spend their full appropriations but there is no way of knowing what will “lapse”.

Base Year Deficit Outcome

The initial January 2009 Budget fiscal forecast for 2009-10 was based on preliminary fiscal results for 2008-09 (the base year), which included data available only to the end of November 2008. Final audited results for 2008-09 were not available to the Department of Finance until August 2009. This means that the final budget outcome for 2008-09 would not have been fully incorporated into the fiscal forecast until the September 2009 Update of Economic and Fiscal Projections. The size and nature of the differences between the preliminary outcome for 2008-09 and the final outcome could have a significant impact on the forecast for 2009-10 and beyond.

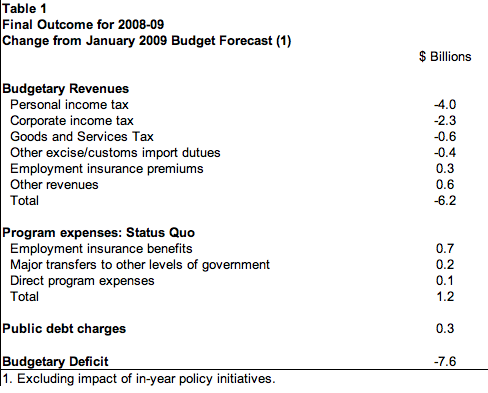

The final audited status quo deficit outcome for 2008-09 was $7.6 billion higher than that forecast in the January 2009 Budget (Table 1). Budgetary revenues were $6.2 billion lower, primarily due to lower personal and corporate income tax revenues. Higher employment insurance benefits (up $0.7 billion) accounted for most of the $1.2 billion increase in program expenses. Public debt charges were $0.3 billion higher. If this information had been available at the time of the January 2009 Budget, the original status quo deficit estimate for 2009-10 would have been close to $8 billion higher than announced, at the time of the budget.

The Impact of Changes in the Economic Environment

A number of the major components of the budgetary balance are very sensitive to changes in economic developments – especially those for personal and corporate income tax revenues, employment insurance benefits and public debt charges. For the January 2009 Budget, nominal GDP results would have been available only for the first nine months of 2008, which were released by Statistics Canada at the end of November 2008. The first estimate for 2008 as a whole was released at the end of February 2009 and revised at the end of May 2009.

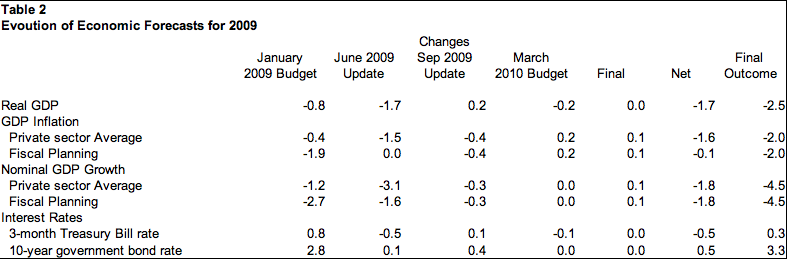

At the time of the January 2009 Budget, there was significant uncertainty surrounding the global economy. This was reflected in the survey of private sector economists, with forecasts of nominal GDP growth for 2009 ranging from an increase of almost 1 per cent to a decline of over 3 per cent. The average of the private sector economic forecasts was a decline of 1.2 per cent.

In the January 2009 Budget, the Department of Finance assumed a decline of 2.7 per cent (Table 2). This raises the issue of why the Department of Finance uses the average of the private sector economic forecasts for fiscal planning purposes, if it adjusts that forecast when it feels it is not prudent enough. (See paper “Time to Make the Budget Planning Process More Accountable, Transparent and Prudent” http://3dpolicy.ca )

In-year estimates of economic growth produced by Statistics Canada are based on partial survey data and related indicators. These are replaced by more complete annual survey and administrative data over time. Two of the major components of nominal GDP, personal income and corporate profits (information based on final tax data from the Canada Revenue Agency) are available usually 2 to 3 years after the fact. This is the same information on which monthly and final personal and corporate income tax remittances are based. In fact, in-year income tax developments can mirror potential adjustments to economic data. As a result, detailed analysis of the monthly results following about six months of data as published in the Fiscal Monitor, are used to update the fiscal projections during the year, rather than basing adjustments solely on changes to the economic forecast.

The Department of Finance disaggregates the average private sector forecasts for real and nominal GDP into its components – personal income, corporate profits, etc. These components have differing effective tax rates. Changes in the composition, therefore, have a significant impact on the forecast of total budgetary revenues. The Department of Finance does not publish its decomposition in the budget documents or the assumed “tax elasticities”.

Personal Income tax and Inadequate Data

Another key difficulty in forecasting personal income tax revenues is that the taxable base is much broader than its underlying economic tax base, as measured by Statistics Canada. Personal income taxes include taxes paid on wages and salaries, commissions, investment income, capital gains and pension income, among others. However, the applicable tax base used for forecasting purposes – personal income as measured by Statistics Canada – excludes certain elements of pension income (withdrawals from tax-assisted retirement savings in registered retirement savings plans and registered pension plans) and capital gains. Given the ageing of the population, withdrawals from these pension plans are becoming a larger component of taxable income while capital gains can be quite volatile.

Accrual versus Cash Accounting

The fiscal projections are presented on an accrual basis of accounting, recognizing tax liabilities when they are earned not when collected, and expense liabilities when they occur not when they are paid. During the course of the year, monthly information on revenue flows is based on cash received by the Canada Revenue Agency, the Canada Boarder Security Agency and individual departments. These cash flows are converted to accruals based primarily on previous years’ experiences. However, during turning points in the economy, these prior years’ adjustments may no longer be representative, thereby resulting in large adjustments at year end.

Parliamentary appropriations are based on a cash basis of accounting. The Department of Finance has to convert these cash appropriations to accruals. This means amortizing cash appropriated for the construction or acquisition of capital assets in a fiscal year to an expense over the estimated useful life of these assets. It also means setting up allowances for valuation against potential losses resulting from claims currently before the court, environment liabilities, employee future benefits, aboriginal land claims, concessions relating loans and loan guarantees, tax receivables and payables, among others. The timing and value of many of these allowances can at times be extremely difficult to predict in advance, resulting in large adjustments after the close of the fiscal year based on assessments undertaken at that time. To guard against potential surprises, the initial forecast may contain a buffer, which is unwound during the course of the year if it is felt it is not needed. In-year consultations with sponsoring departments, the Office of the Comptroller General and the Office of the Auditor General are undertaken with the objective of early identification of potential adjustments.

Departmental “Lapse”

Departments are appropriated funds by Parliament to spend during the course of the fiscal year. They cannot exceed that amount, without consequences. As a result, they typically spend less than the total amount appropriated. The Department of Finance attempts to estimate how much departments will lapse – not spend – of the total amount appropriated, based on previous years’ experiences and incorporates this amount into its direct program expense forecast. However, this amount can be quite volatile from year-to-year depending upon the amount of new funding allocated during the year (delays in signing agreements, etc. could result in delays in getting the funds out the door), timing of elections (delays in approvals), weather, among others.

Conclusion

The above factors have varying impacts on the differences between the forecast and final outcome over time. They illustrate how difficult it is to translate the economic planning assumptions into credible fiscal projections for budget planning purposes. Accrual accounting and the fact that departments and agencies are still on cash-based appropriations further complicate the process. Turning points in the economic cycle illustrate that the use of previous years’ relationship may no longer be applicable.

More information is required in budget and related documents for the public to assess the fiscal forecasts. Part of this would be satisfied if the Government changed its budgetary planning process as suggested in our paper “Time to Make the Budget Planning Process More Accountable, Transparent and Prudent”.

The Government is currently evaluating of the costs and benefits of accrual appropriations. Such information would require departments and agencies to provide more accurate data and provide Parliament with a more comprehensive basis for control and approval. It should minimize the impact of large end-of-year surprises. In addition, the estimates used to translate cash revenues into accruals needs to be reviewed on an ongoing basis. The Auditor General has raised a number of these issues in her “Observations” on the federal government’s financial statements but little progress has been made to date.

---

[1] Review of the Forecasting Accuracy and Methods of the Department of Finance: Ernst & Young September 1994 and Review of Canadian Federal Fiscal Forecasting – Processes and Systems: Tim O’Neill, O’Neill Strategic Economics, June 2005

[2] A forthcoming companion piece examines the in-year changes to the fiscal projections for 2009-10, from the January 2009 Budget to the final audited results, as published in the Public Accounts of Canada 2010, highlighting the major factors contributing to the changes in the fiscal projections.

Add new comment