“A Faster Track to Fiscal Balance”-Unfortunately Not.

Introduction and Summary

On February 3, 2011, the C.D. Howe Institute released its 2011Shadow Budget[1] entitled A Faster Track to Fiscal Balance, arguing that federal government should undertake aggressive actions to restrain the growth in program expenses in order to achieve a fiscal surpluses one year earlier than forecast in the October 2010 Update[2]. The authors propose that the some of the savings be directed to new tax and spending initiatives. The 2011 Shadow Budget, they argue, would protect Canadians from possible debt-market disruptions arising from sovereign-debt concerns and would put federal debt on a downward track before the pressure of population ageing on government finances intensifies. This note comments on the Institute’s updated fiscal projections and proposed initiatives.

In summary, we believe that the Institute’s fiscal projections understate the magnitude of the federal deficit and that the some of the proposed restraint measures are unrealistic and will not yield their estimated savings. The Institute’s shadow budget will not lead to a balanced budget in 2015-16 let alone a year earlier.

Assessment of Fiscal Projections

The Institute did not present its own fiscal forecast but instead used those contained in the government’s October 2010 Fiscal Update projections. They did, however, adjust the October 2010 budgetary track for some additional prudence, reducing revenues (and therefore increasing the deficit) by $0.9 billion in 2013-14 and $2.2 billion in both 2014-15 and 2015-16. In the October 2010 Update, the Department of Finance had included an adjustment for risk of $1.5 billion in both 2011-12 and 2012-13, but then reduced it to $0.8 billion in both 2014-15 and 2015-16. We questioned the downward profile of this adjustment, arguing that risks/uncertainties increase over time rather than decline and that larger and increasing adjustments for risk should have been made. We support the Institute’s adjustments for risk but would argue that they should have been higher in the last two years.

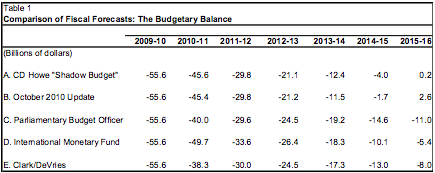

Table 1 compares the Institute’s budgetary projections to the October 2010 Update, the Parliamentary Budget Officer (PB))[3], the International Monetary Fund[4] (IMF) and our own projection[5]. The Institute’s fiscal forecast is only marginally different from the October 2010 Update, due to additional prudence.

However, as noted by the PBO and our analysis, there are a number of problems with the October 2010 Update fiscal track. Based on financial results for the first eight months of 2010-11 and adjusting for the large extra-ordinary liabilities booked in 2009-10, which inflated the deficit outcome for that year, the deficit for 2010-11 will be about $7 billion lower than forecast in the October 2010 Update. In addition, the October 2010 Update projections for employment insurance premiums, other revenues and direct program expenses in the outer years, are questionable. As a result, the October 2010 Update understates the deficit for 2012-13 and beyond. The IMF, PBO, and we, forecast a deficit of between $5.4 billion and $11 billion for 2015-16.

Assessment of Proposed Expenditure Reductions

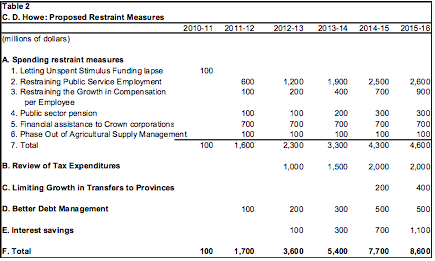

The Institute proposes expenditure reduction measures affecting program expenses and tax expenditures amounting to $1.7 billion in 2011-12, rising to $8.6 billion in 2015-16 (see Table 2). The initiatives are similar to those proposed in Shadow Budgets in previous years. However, there are some issues as to the feasibility of those proposals, thereby putting in question the savings to be realized. The following sections comment on each of the initiatives proposed.

1. Letting Unspent Stimulus Funding Lapse

The Institute notes that funding for some of the stimulus measures has been extended to October 31, 2011 from March 31, 2011. They propose that there be no extension beyond October 31, 2011 and assume that this will result in a savings of $100 million in 2011-12.

However, the extension was only announced on December 2, 2010, well after the release of the October 2010 Update. The Update assumed that all of the two-year stimulus funding would end on March 31, 2011.

Therefore, the savings of $100 million are just not there.

2. Restraining Federal Public Service Employment

The Institute notes that federal public service employment, excluding military and RCMP uniformed personnel and federal government business enterprise employees, has increased by about 35 per cent between 1999 and 2009, (from 224,600 to 302,000), well in excess of overall growth in population of 11 per cent over that period. The Institute recommends that employment in the federal public service be cut by 2 percent per year for the next four years. This would result in a reduction of about 18,000 positions. They believe that this could be achieved through attrition, by eliminating one in every two positions that open through retirement.

This is the most important recommendation in the Shadow Budget and one the government seems likely to adopt in its attempt to justify the administrative savings proposed in the 2010 budget.

Unfortunately this proposal will not produce the desired savings.

First, to realize their savings, the average compensation per employee would need to be about $130,000, well in excess of the $97,000 they claim for 2009-10. Using the lower compensation figure would reduce the estimated savings by $0.8 billion in 2015-16.

Second, to properly access the feasibility of this proposal, one needs to understand why this growth in employment occurred. Between 1999 and 2002, employment increased by about 4.8 per cent on average per year. There were two main reasons for this. Following the implementation of Program Review and the elimination of some 40,000 employees, the Treasury Board Secretariat undertook a Program Integrity Review, as it was discovered that Program Review reductions had resulted in serious underfunding in several departments. Although some programs were eliminated, departments attempted to secure their Program Review targets through efficiency and administrative savings, which were not sustainable. As a result, incremental funding had to be provided in order to maintain service, particularly in areas of health and safety. Using 1999 as the base for comparison, therefore, may not be appropriate as it was not sustainable.

Following 9/11, incremental funding for new security initiatives, accompanied by an increased in the number of employees, was provided. Between 2002 and 2005, employment growth was restrained to less than one per cent per year. Between 2005 and 2009, employment increased by an annual average of 3 per cent per year. Part of this growth is temporary, related to the measures in the Economic Action Plan, with the result that the employment levels should decline once the stimulus measures terminate at the end of 2011-12.

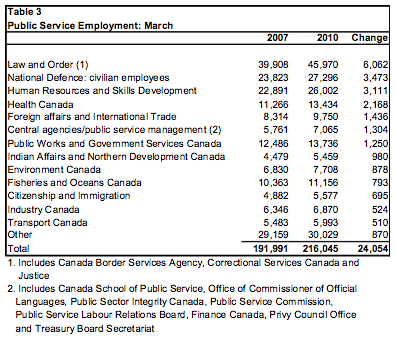

Table 3 summarizes the growth in federal government employment, excluding military and RCMP uniformed personnel and federal government business enterprise, between March 2007 and March 2010. .

About 40 per cent of the increase over the last three years has been in the law and order departments (Correctional Services Canada and related agencies, Justice and the Canada Border Services Agencies) and defense civilian staff. Some of the increases in other departments possibly relate to the administration of the two-year stimulus spending. The largest percentage increase was recorded in the central agencies/public service management group.

Advocating a reduction of 2 per cent per year without identifying programs to be eliminated/reduced will not result in the proposed savings. Experience clearly indicates that such unspecified measures never generate significant or sustained savings over time. To the Institute’s credit, they do acknowledge that a better approach would be a reduction or elimination of lower-value programs and the associated personnel through a review process. For this exercise to be credible, they should have identified the programs to be eliminated/reduced. Based on the above, we do not believe that the proposed savings are achievable without a full program review. In our pre-budget submission to the Minister of Finance (www.3dpolicy.ca) we recommended that he include a detailed list of program cuts for each Department under Review.

3. Restraining the Growth in Compensation per Employee

The Institute proposes to limit total-per-employee compensation to an annual growth of 1 percent over the forecast period. Total compensation per employee consists of many different elements, including not only negotiated/imposed wage settlements, bracket creep (employees moving up within their pay range), composition of employment (professional vs clerical), pay equity, pension and other future employee benefit costs driven in part by market conditions, Canada and Quebec Pension Plan contributions (which increase by the annual increase in the industrial wage), among others. To achieve a cap of 1 per cent would most likely require an absolute cut in wages and salaries. The Institute provides no details how their cap would be achieved. It is doubtful that a 1 per cent would be achieved, although it is important that total-per-employee compensation not lead those in the private sector.

4. Tackling the Cost of Ottawa’s Employee Pension Plans

The Institute proposes a gradual move to a 50:50 employer/employee financing split and an increase in the combined contribution rate from nearly 20 per cent of pay to about 24 per cent over four years.

The Institute’s rationale for increasing the overall contribution rate from 20 per cent of pay to 24 per cent is their claim that the use of “fair-value” calculations reveals that the pension liabilities are much higher than reported, due to the use of a too high discount rate. However, the actuarial calculations of the pension liabilities are based on “generally-accepted accounting principles”, and the discount rate used is consistent with these principles. The Auditor General of Canada has not raised this as an issue of concern. We do not support the Institute’s claim, based on the evidence to date.

We do support, however, changes to the funding and management of the federal employees’ pension plans, including the move to more equitable contribution rates, changes in retirement provisions for new employees, among others. Although the savings in the short term are relatively small, these proposals should be actively considered as the savings do grow over time. In addition, the Government should give up its total control over these plans and consider joint management/risk taking with its employees. This would significantly reduce its liabilities with respect to its pension obligations.

5. Financial Assistance to Crown Corporations

The Institute claims that subsidies to Crown corporations have increased by 50 per cent since 2006-07 and propose, that to improve efficiencies, these subsidies should be reduced by 10 per cent from current levels.

Of the increase of about $2.5 billion since 2006-07, about three-quarters relates to measures introduced as part of the Economic Action Plan. These are not ongoing. In addition, the figure for 2009-10 includes $172 million for PPP Canada Inc., which was not in existence in 2006-07. As a result, the underlying increase since 2006-07 is about $300 million rather than $2.5 billion.

In addition, Crown corporation expenses are presented on a gross basis, which includes expenses directly financed by revenues from the private sector. These revenues are part of budgetary revenues. Although there should be extensive review of Crown corporation expenses, it is doubtful that the savings proposed can be realized without eliminating some of the corporations and/or substantially increasing the charges for the use of the services.

6. Initiating a Phase-out of Agricultural Supply Management Programs

The Institute proposes the phase-out of Canada’s supply management system for dairy, poultry and eggs over a period of 20 years. In addition, they propose a phased reduction of the tariffs that block foreign imports of these products. The bulk of the savings would be devoted to the retirement of production quotas to mute the impact that higher imports and the auctioning of new quotas would have on the affected farmers’ incomes.

We would support any measure that removes distortions and increases economic efficiency. However, everyone knows why this system remains in place!

7. Review of Tax Expenditures

The Institute proposes an extensive review of tax expenditures to identify and phase out/eliminate those failing the tests of economic efficiency and cost effectiveness. Such an exercise is long overdue and should be strongly supported. Tax expenditures are similar to direct program initiatives but without the visibility and scrutiny afforded program expenses. Although the costs of the various tax expenditures are presented annually by the Department of Finance in the Tax Expenditure Report, there is little public discussion on the cost-effectiveness of these expenditures.

The Institute proposes that a panel of independent academics and tax experts be established to conduct a rigorous review of all tax expenditures to phase-out those failing the tests of economic efficiency and cost effectiveness. We strongly support this recommendation.

8. Federal-Provincial Relations Post-2013

Under current legislation, transfers under the Canada Health Transfer (CHT) are to grow by 6% per year to 2013-14 while those under the Canada Social Transfer (CST) are to grow by 3% per year to 2013-14. For planning purposes only, the Department of Finance, in its October 2010 Update, assumes that these growth rates will continue beyond 2013-14.

The Institute proposes to freeze major these transfers at their 2013-14 levels. In addition, the federal government would reduce its federal taxes (they advocate corporate income taxes) by 90 per cent of the difference between the October 2010 Update projections for the CHT/CHT and the flat-lined amount from 2014-15 on. In turn, the provinces would raise their taxes (they advocate sales taxes) to make up the shortfall or to ensure their health and social programs are adequately funded.

They argue that this would improve provincial responsibility for these programs and how they are funded. In addition, they propose that the accountability for the Fuel Tax Transfer be improved by lowering the federal fuel tax in provinces that agree to design their own mechanisms for delivering fuel tax revenues to the jurisdictions in which they are raised. This initiative would be cost neutral but would match revenue raising authority and spending responsibility.

The current legislation expires at the end of 2013-14. The federal government is obliged to begin discussions with the provinces and territories at least a year before the expiry of the legislation. However, given the ageing of the population and the accompanying pressures on health care costs, it is important that such discussions begin much earlier and involve the public, rather than being held behind closed doors.

The Institute does not consider any alternative options for dealing with demographic pressures other than cutting transfers.(www.3dpolicy.ca)

9. Better Debt Management

The Institute proposes that the federal government expand its real return bonds (RRBs) program. There is no reason why this shouldn’t be explored further. In addition, the Canada Savings Bond program is costly to administer and out dated given the availability of private sector savings instruments. The federal government should accept the recommendations of a private sector report and phase out this program.

10. Other

The Institute proposes a number of future priorities, such as moving to comprehensive corporate group taxation, expanding the basic personal amount to all individual investors, more comprehensive treatment of returning travelers, elimination of withholding taxes on Canada-US cross-border dividend payments, extending the dividend tax credit, and eliminating regionally extended employment insurance benefits. As these are “future priorities”, we are not commenting on them at this time.

There is no immediate urgency for any of these and the list seems simply to reflect the “preferences’ of the Institute’s corporate members. However, some of the tax priorities could be assumed under the expert panel review of tax expenditures. There is a need to review the employment insurance program. The Minister of Finance has indicated that the premium rate setting process needs to be re-examined. Perhaps other elements of the program could be reviewed at the same time

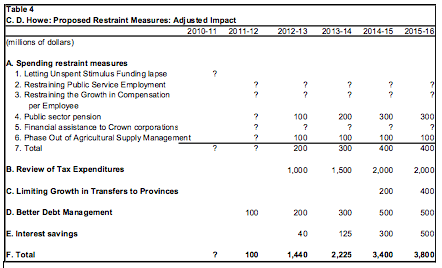

Shadow Budget Measures: Adjusted

Table 4 adjusts the measures included in the Shadow Budget, based on the above assessment. Instead of savings of $8.6 billion in 2015-16, we believe that their initiatives would yield only $3.8 billion, insufficient to achieve a budget surplus.

[1] C. D. Howe Institute Commentary: A Faster Track to Fiscal Balance: The 2011 Shadow Budget: by Alexandre Laurin and William B.P. Robson

[2] Update of Economic and Fiscal Projections, October 2010: Department of Finance

[3] Economic and Fiscal Update November 3, 2010 Office of the Parliamentary Budget Officer

[4] 2010 Article IV Consultations with Canada: International Monetary Fund December 22, 2010.

[5] How Credible is the October 2010 Fall Economic and Fiscal Update? October 2010 C. Scott Clark and Peter DeVries 3dpolicy

Add new comment