Canada’s Economic Action Plan: Seventh Report What the Report Didn’t Say

On January 31, the Government released its Seventh Report on the Economic Action Plan (EAP). The report provided an update on the status of the various measures introduced since the January 2009 Budget. As in the previous reports, it was full of self-congratulations on taking timely and aggressive actions to ensure a quick recovery from the 2008 recession. It again contained selective quotes supporting the Government’s actions. On balance, however, the Seventh Report provided little new information. There were, however, a number of things that the Report did not include.

Changes in Estimates since the January 2009 Budget

The Report provided an update of the cost of the EAP’s stimulus package. The aggregates differed from those contained in other reports. This note focuses on the changes between the estimates presented in the January 2009 Budget and the Seventh Report (Table 1).

The cumulative federal fiscal cost of the measures announced in the January 2010 Budget amounted to $39.3 billion. In the Seventh Report, this was revised up by $7.8 billion to $47.1 billion. Increased assistance to the auto sector accounted for most of this change. Originally, the assistance to the auto sector was estimated at $2.7 billion, but was later increased to $9.2 billion.

The Department of Finance originally estimated the impact of freezing the employment insurance premium rates for 2009 and 2010 at $2.4 billion. Premium rates for 2011 were to be set by the “independent” Canada Employment Insurance Financing Board, subject to an annual change of no more than 15 cents (employee rate) per year. The Government can overrule the Board’s recommendation. Prior to the October 2010 Update, the Government announced that the employee rate for 2011 would be increased by only 5 cents . For some reason, this reduction of 10 cents for the first three months of 2011 resulted in upward revisions to the fiscal costs not only for 2010-11 (up $747 million) but for 2009-10 (up $374 million) as well. No explanation was provided.

The cost of upgrading federal facilities was increased by $1.0 billion. Virtually all components identified in the January 2010 Budget (e.g., improved rail system, repair of federal buildings, cleanup of contaminated sites, aviation security, small craft harbors, among others) have received incremental funding. Apart from the increased funding for aviation security, little supporting evidence was found to support these other increases.

Additional changes to employment insurance benefits, since the January 2009 Budget, cost an additional $0.9 billion. These included extension of benefit weeks, increased costs for long-tenured workers and working-sharing programs, along with the introduction of Career Transitional Assistance program for long-tenured workers.

Dampening the impact of these increases was the lower-than-expected take-up under the Home Renovation Tax Credit and First Time Home Buyers’ Tax Credit ($0.8 billion in total). In addition, funding under the accelerated payments under base funding for provincial, territorial and municipal infrastructure and under the Green Infrastructure Plan was lower than expected ($0.9 billion).

The Government extended the deadline for four infrastructure initiatives from March 31, 2011 to October 31, 2001. These were the Infrastructure Stimulus Fund, the Building Canada Communities Component Top-up, the Recreational Infrastructure Canada program and the Knowledge Infrastructure Program. In the January 2009 Budget, these programs were allocated an aggregate $3.5 billion in both 2009-10 and 2010-11. However, only $1.6 billion of the original $3.5 billion was expended in 2009-10. The difference has been reprofiled to 2010-11. The Government acknowledges that some of the amount currently recorded in 2010-11 ($5.4 billion) will be expended in 2011-12. The amounts will not be known until closer to the end of 200-11. All other things being equal, the net impact of this extension will be reduce the deficit in 2010-11 and increase it in 2011-12.

International Monetary Fund

The Report makes a number of references to the latest International Monetary Fund (IMF) 2010 Article IV consultations with Canada. It notes that the IMF forecasts Canada’s Total Government Budgetary Balance to be surplus in 2015. However, the Report fails to note that this is due to the growing surpluses in the Canada and Quebec Pension Plans, given the premium rate changes made in the mid-1990s to put these plans on a sustainable path. The Report also fails to acknowledge that the IMF forecasts the federal government to still be in a deficit in 2015-16.

The Report also failed to mention the IMF”s concern regarding the significant risks to long-term fiscal sustainability from the budgetary impact of population ageing and health-care inflation. Perhaps the Government will focus its Second Economic Action Plan on these issues and adopt the IMF’s advice when its noted “ the importance of increasing transparency and communication about these challenges (demographic) and their long-run implications, (and) to increase public awareness and contribute to a debate about possible solutions”.

Job Impact of the Economic Action Plan

In Budget 2010, the Department of Finance provided an estimate of the number of jobs created/maintained because of the Economic Action Plan, using the Department’s Canadian Economic and Fiscal Model (CEFM)[1]. The funding for the various Economic Action Plan initiatives was allocated to the applicable categories in the model. Each of these categories has a specified economic activity multiplier, which take into account first-round direct, indirect and induced impacts of the increased spending on economic growth. The employment impact of the assistance to the auto sector was estimated separately.

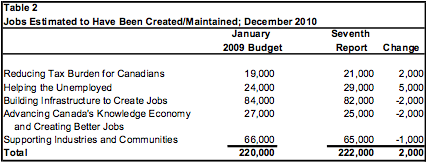

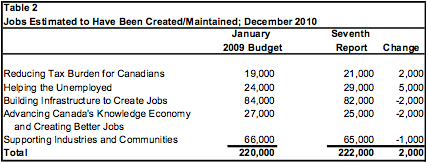

Assuming that all of the stimulus funding is allocated within the timeframe specified, the Department of Finance originally estimated that 220,000 would be created or maintained by the end of 2010. The Report updates this estimate to 222,000 jobs by the end of 2010. The Report provides an estimate of the value of the Economic Action Plan funds flowing as of December 2010. This information was not provided in the January 2009 Budget. The Report does contain a table showing the allocation of jobs by main theme. We have compared this to the figures provided in the January 2009 Budget (Table 2).

As Table 1 illustrates, most of the incremental funding to the Economic Action Plan since the January 2009 Budget was due to increased assistance to the auto sector. Yet, the estimate of jobs maintained due to the government support was calculated separately. The incremental support should have no incremental impact on the jobs estimate. The fiscal cost of “Reducing the Tax Burden” was somewhat lower than estimated in the January 2009 Budget estimate, yet an additional 2,000 were created by the measure in the latest Report. The incremental fiscal stimulus of about $2 billion for increased employment insurance benefits and limiting the rate increase in EI premium rates to 5 cents in 2011 saved 5,000 jobs (no wonder increases in EI premium rates are called job killers). For the other components of the Plan, a net reduction in stimulus funding resulted in a loss of 5,000 jobs.

Although the Department of Finance argues that the multipliers used were “prudent”, changing the assumptions underlying the “multipliers” will provide different estimates of the impact on economic growth and employment – either higher or lower. It will take a lot more analysis than has been done so far before we can provide an acceptable estimate of the jobs created by the EAP.

[1] Budget 2010 Annex 1 page 280 - 288.

Add new comment